The Ins and Outs of OAF Diligence

OAF strives to be thorough yet efficient with our diligence, tapping into the expertise of our investors to make great investment decisions and employing a structured yet flexible process that rewards everyone involved with an extraordinary learning experience.

OAF & Brentwood Group: 2016 Annual Compensation Survey of VC-Backed Companies in OR and SW WA

Julianne Brands - July 2016

We’re excited to announce that our 2016 Annual Compensation Survey of Venture-Backed Companies in OR and SW WA results are now live!

SaaS Business Model & Metrics: Key Workshop Learnings

Julianne Brands - April 2016

In the last ten years, we’ve been lucky enough to see successful exits of our portfolio companies. Of these exits, we’ve noticed a particular theme - 10 of them have been SaaS companies.

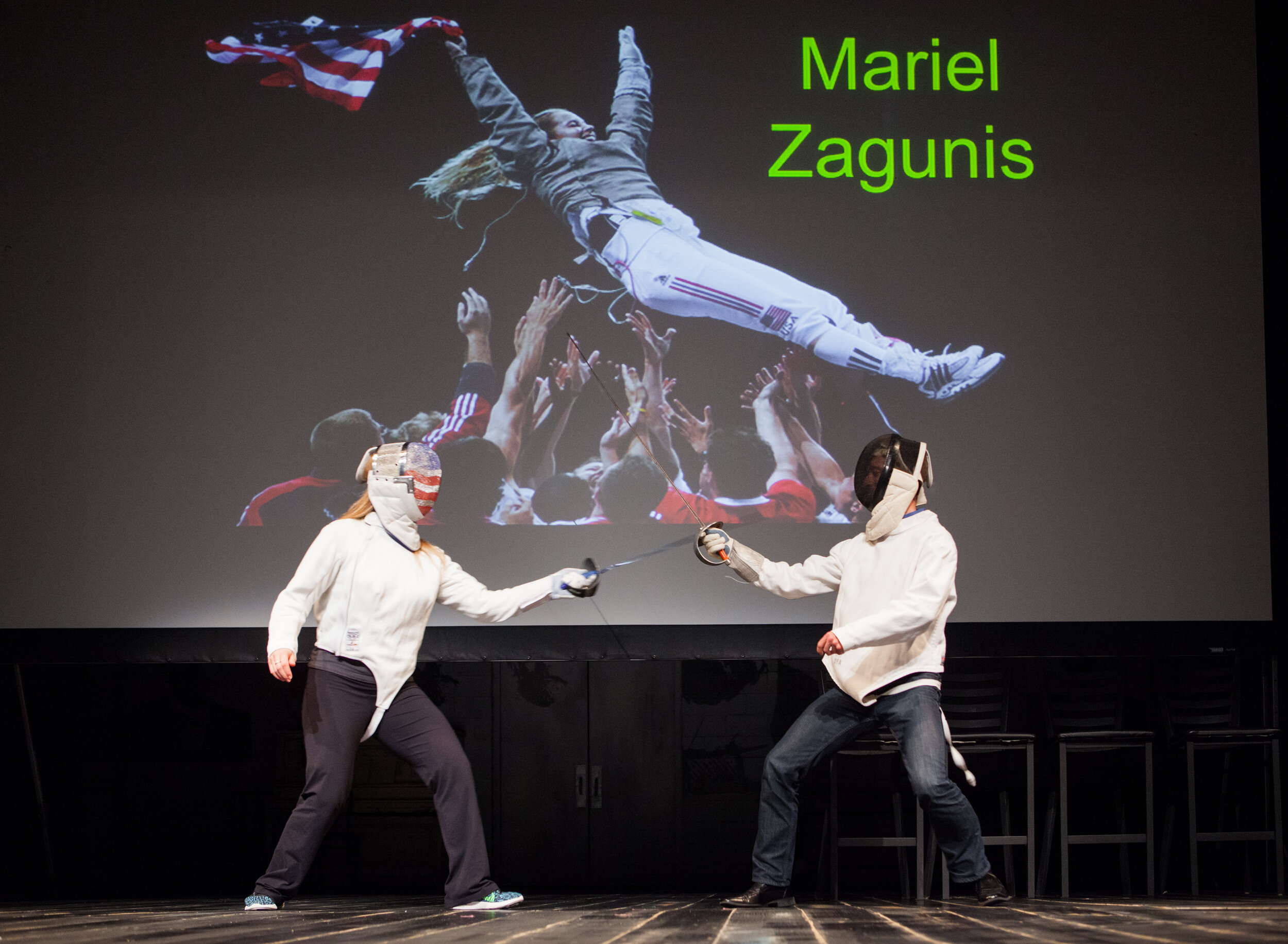

2016 Annual Meeting

Lynn Fletcher - March 2016

Thanks to all who were able to join us for the OAF 2016 Annual Meeting!

Ducky vs. Sucky: What makes certain sectors more (or less) attractive than others for early-stage venture investors?

Julianne Brands - Feb 2016

Here at the Oregon Angel Fund, we see a wide range of sectors, industries, and business models, so, how do we frame our decision making within the context of specific sectors? We hosted a workshop to find out...

Food for Thought: The Do’s, Don’ts and Donut’s of Food Investing.

Julianne Brands - Feb 2016

Food and beverage startups in Oregon are making money - bringing in $1B in financing in 2015 alone. We hosted a workshop, Food for Thought: The Do’s, Don’ts and Donut’s of Food Investing, to dig into the $16B Oregon industry.